Your Car depreciation formula images are available in this site. Car depreciation formula are a topic that is being searched for and liked by netizens today. You can Get the Car depreciation formula files here. Download all royalty-free photos.

If you’re searching for car depreciation formula pictures information linked to the car depreciation formula keyword, you have visit the ideal blog. Our website frequently gives you suggestions for seeking the highest quality video and picture content, please kindly surf and locate more enlightening video content and images that fit your interests.

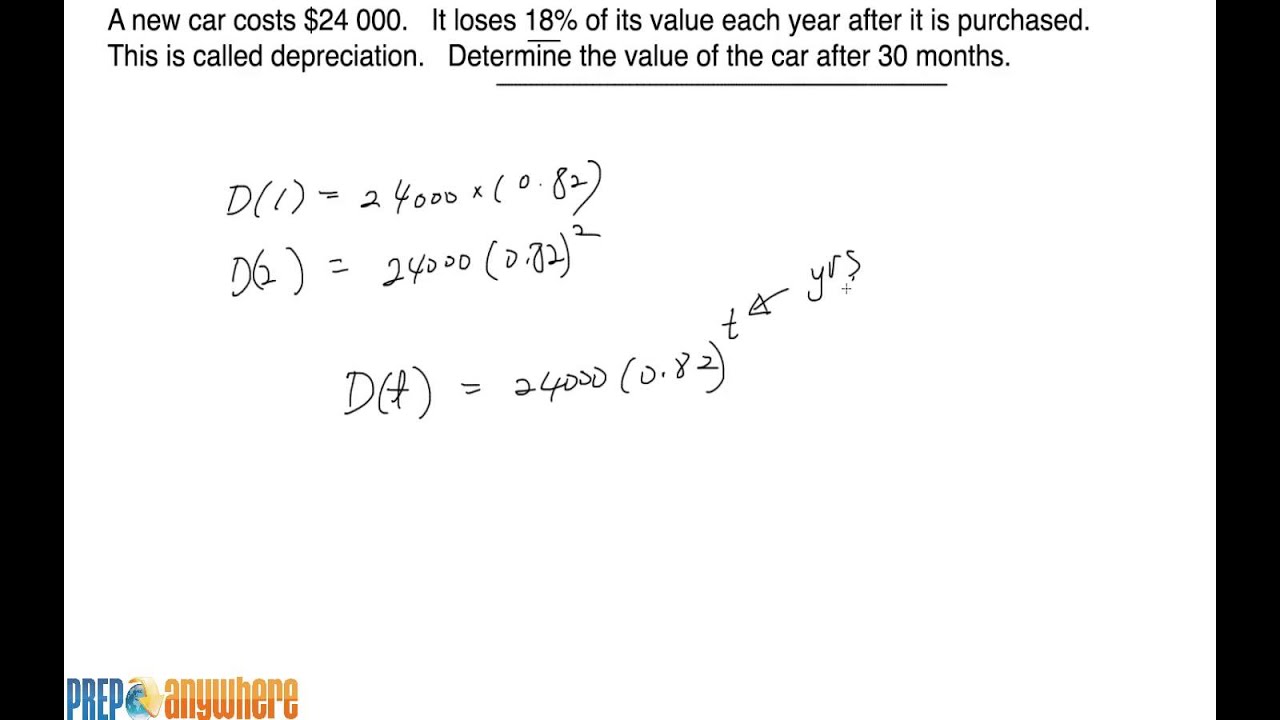

Car Depreciation Formula. Where, a is the value of the car after n years, d is the depreciation amount, p is the purchase amount, Similarly, we can calculate the closing value for the remaining years. Depreciation enables companies to generate revenue from their assets while only charging a fraction of the cost of the asset in use each year. Now that you have the formula, let’s say for example that you’re trying to calculate the depreciation of a vehicle with an msrp of $32,099.

Exponential Function Application (y=ab^x) Depreciation From youtube.com

Exponential Function Application (y=ab^x) Depreciation From youtube.com

We have also built historical depreciation curves for over 200 models, many of which go back as far as 12 For example, if the pricing of a car is $20,000 new and has a resale value of $11,000, that is a $9,000 difference. We need to define the cost, salvage, and life arguments for the sln function. A car that doesn�t depreciate as much will save you more money than one that costs a little less to fill up and lasts longer between refuels. Depreciation of passenger vehicles for tax purposes can be claimed when used to produce taxable income. $32,099 x 0.75 = $24,074

Salvage is listed in cell c3 (10,000);

Value of the car upon purchase x (days owned ÷ 365) x (200% ÷ effective life in years) under this method, the car’s depreciation is calculated on the base value of the car. Sld is easy to calculate because it simply takes the depreciable basis and divides it evenly across the useful life. In case of diminishing value technique, the estimate is based on the worth of the car. Value of the vehicle after the fifth year x 0.825. Salvage is listed in cell c3 (10,000); Now that you have the formula, let’s say for example that you’re trying to calculate the depreciation of a vehicle with an msrp of $32,099.

Source: youtube.com

Source: youtube.com

Value of the car upon purchase x (days owned ÷ 365) x (200% ÷ effective life in years) under this method, the car’s depreciation is calculated on the base value of the car. Sld is easy to calculate because it simply takes the depreciable basis and divides it evenly across the useful life. That said, there are several specific factors that affect or modify vehicle. So effectively price, minus depreciation, times by years owned. Similarly, we can calculate the depreciation amount for remaining years.

Source: youtube.com

Source: youtube.com

First, find the difference between the new car value and the approximate resale value listed by edmunds.com or kelley blue book�s kbb.com. The sln (straight line) function is easy. Our car depreciation calculator uses the following values ( source ): Sld is easy to calculate because it simply takes the depreciable basis and divides it evenly across the useful life. Depreciation of passenger vehicles for tax purposes can be claimed when used to produce taxable income.

Source: panfu-bloginipe123.blogspot.com

Source: panfu-bloginipe123.blogspot.com

Similarly, we can calculate the depreciation amount for remaining years. In case of diminishing value technique, the estimate is based on the worth of the car. Its value indicates how much of an asset’s worth has been utilized. After two years, your car�s value decreases to 69% of the initial value. Depreciation of most cars based on ato estimates of useful life is 25% per annum on a diminishing value basis (or 12.5% of the vehicle cost for 8 years).

Source: youtube.com

Source: youtube.com

Bought for r21 406.35 incl vat therefore use the vat exclusive amount and then calculate the depreciation. Similarly, we can calculate the closing value for the remaining years. The cost is listed in cell c2 (50,000); The car depreciation formula for this method is as follows: The decline in cash value (depreciation) on a car can be calculated by the formula:

Source: putney-lettings.blogspot.com

Source: putney-lettings.blogspot.com

To estimate how much value your car has lost, simply subtract the car’s current fair market value from its purchase price, minus any sales tax or fees. If you have an asset that cost $1,000 and has a residual value of $100 after 5 years, you can calculate the annual straight line depreciation of the asset as follows: You can also use our lease calculator to get an idea of the value “d” over years. Calculation of closing value of 1 st year. After two years, your car�s value decreases to 69% of the initial value.

Source: ucihahi.blogspot.com

Source: ucihahi.blogspot.com

Calculation of closing value of 1 st year. Under this method, we transfer the amount of depreciation every year to the sinking fund a/c. When it’s time to file your return, you’ll use form 4562 to report your car’s depreciation. Diminishing value method of calculating car depreciation formula: Our car depreciation calculator uses the following values ( source ):

Source: jaxtr.com

Source: jaxtr.com

Where, a is the value of the car after n years, d is the depreciation amount, p is the purchase amount, Depreciation enables companies to generate revenue from their assets while only charging a fraction of the cost of the asset in use each year. Sld is easy to calculate because it simply takes the depreciable basis and divides it evenly across the useful life. What’s the formula for depreciation? So effectively price, minus depreciation, times by years owned.

Source: exceltemplate.net

Source: exceltemplate.net

Each year the depreciation value is the same. For all remaining years, multiply the previous year�s reduced value by the current year�s depreciation rate, and subtract the result from the previous year�s value. We have also built historical depreciation curves for over 200 models, many of which go back as far as 12 Factors that affect used car valuation Similarly, we can calculate the closing value for the remaining years.

Source: dbestautocars.blogspot.com

Source: dbestautocars.blogspot.com

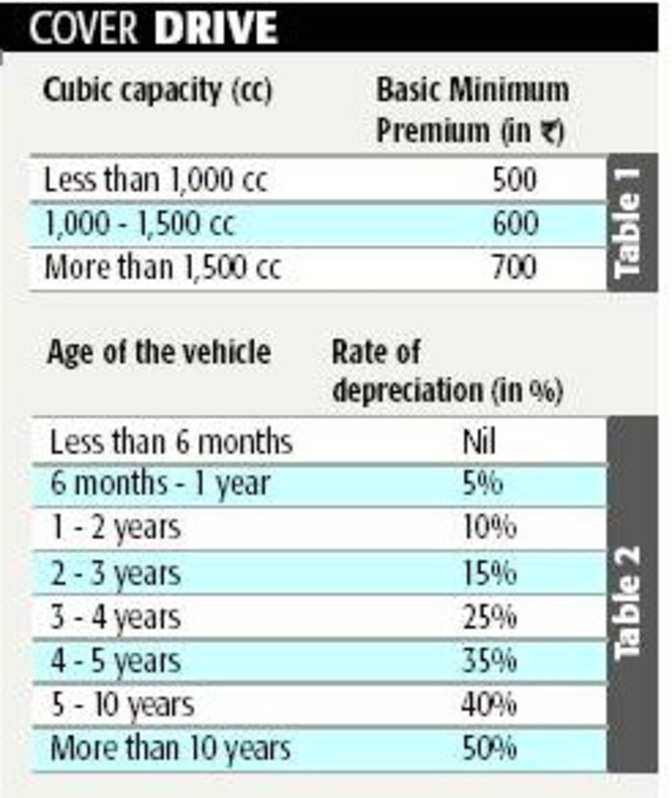

Note how the book value of the machine at the end of year 5 is the same as the salvage value. Similarly, we can calculate the closing value for the remaining years. Value of the vehicle after the fourth year x 0.825. Sld is easy to calculate because it simply takes the depreciable basis and divides it evenly across the useful life. Even car/bike parts have a specific formula for calculating depreciation, that can affect your contribution in case of a claim.

Source: putney-lettings.blogspot.com

Source: putney-lettings.blogspot.com

Value of the vehicle after the fourth year x 0.825. When it’s time to file your return, you’ll use form 4562 to report your car’s depreciation. If you’re considering buying a car, look up the fair market value of older versions of the make and model to get a sense of the car’s value down the road. Value of the vehicle after the fifth year x 0.825. Its value indicates how much of an asset’s worth has been utilized.

Source: omnicalculator.com

Source: omnicalculator.com

In case of diminishing value technique, the estimate is based on the worth of the car. Each year the depreciation value is the same. Using the straight line method, the. The sln (straight line) function is easy. So $11,400 ÷ 5 = $2,280 annually.

Source: abbiei-duck.blogspot.com

The sln function performs the following calculation. Value of the car upon purchase x (days owned ÷ 365) x (200% ÷ effective life in years) under this method, the car’s depreciation is calculated on the base value of the car. We have also built historical depreciation curves for over 200 models, many of which go back as far as 12 Over the four years following, the value will decrease at a rate of approximately 10% annually (our car depreciation formula will break this down in more detail). So effectively price, minus depreciation, times by years owned.

Source: marelidavidson14.blogspot.com

Source: marelidavidson14.blogspot.com

The sln (straight line) function is easy. After three years, your car�s value decreases to 58% of the initial value. Know how car depreciation rate is calculated and how it affects idv of your car in each year. There is a simple formula to calculate the depreciation of your car. A car that doesn�t depreciate as much will save you more money than one that costs a little less to fill up and lasts longer between refuels.

Source: howcarspecs.blogspot.com

Source: howcarspecs.blogspot.com

Bought for r21 406.35 incl vat therefore use the vat exclusive amount and then calculate the depreciation. Read more on a car can be calculated on the following formula: Now that you have the formula, let’s say for example that you’re trying to calculate the depreciation of a vehicle with an msrp of $32,099. Salvage is listed in cell c3 (10,000); Value of the vehicle after the fourth year x 0.825.

Source: howcarspecs.blogspot.com

Source: howcarspecs.blogspot.com

Factors that affect used car valuation If you want to calculate the depreciation of your car, you can use two different types of formulas: The car depreciation formula is based on a quite simple calculation. First, find the difference between the new car value and the approximate resale value listed by edmunds.com or kelley blue book�s kbb.com. If you’re considering buying a car, look up the fair market value of older versions of the make and model to get a sense of the car’s value down the road.

Source: pinterest.com

Source: pinterest.com

When it’s time to file your return, you’ll use form 4562 to report your car’s depreciation. Over the four years following, the value will decrease at a rate of approximately 10% annually (our car depreciation formula will break this down in more detail). The car depreciation formula is based on a quite simple calculation. Prime cost method for calculating car depreciation formula cost of running the car x (days you owned÷ 365) x (100% ÷ effective life in years) = lost value What’s the formula for depreciation?

Source: brokeasshome.com

When it’s time to file your return, you’ll use form 4562 to report your car’s depreciation. Even car/bike parts have a specific formula for calculating depreciation, that can affect your contribution in case of a claim. Depreciation after first year of ownership = purchase price x.20% depreciation after year two = year one value x.10% depreciation after year three = year two value x.10% and so on, for each year you’ve owned the vehicle. It starts with the purchase amount, and then factors in the years of ownership and the typical rate of depreciation per year, weighted towards the initial depreciation from new. Depreciation of most cars based on ato estimates of useful life is 25% per annum on a diminishing value basis (or 12.5% of the vehicle cost for 8 years).

Source: chik-n-scrap.blogspot.com

Sinking fund or depreciation fund method. So effectively price, minus depreciation, times by years owned. Read more on a car can be calculated on the following formula: In case of diminishing value technique, the estimate is based on the worth of the car. That said, there are several specific factors that affect or modify vehicle.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title car depreciation formula by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.