Your Car allowance taxable images are available. Car allowance taxable are a topic that is being searched for and liked by netizens today. You can Download the Car allowance taxable files here. Get all royalty-free photos and vectors.

If you’re searching for car allowance taxable images information related to the car allowance taxable keyword, you have come to the right site. Our site frequently gives you suggestions for downloading the highest quality video and image content, please kindly hunt and find more enlightening video articles and graphics that fit your interests.

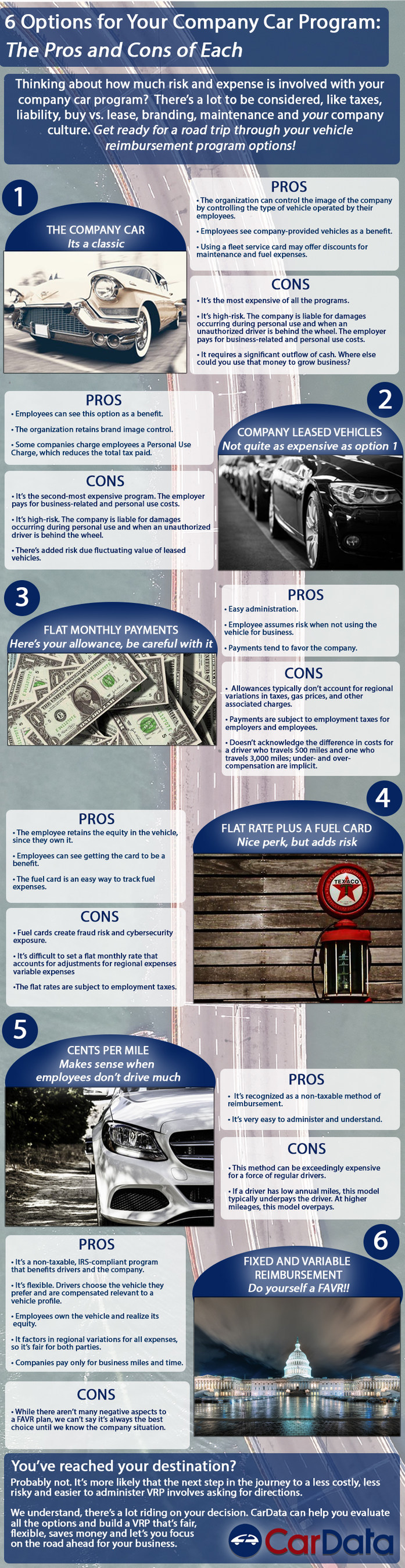

Car Allowance Taxable. There are many factors to consider when looking at car allowances and reimbursements, such as whether it is a taxable allowance or not, whether superannuation applies or not, and whether the employee’s award governs any allowances and entitlements. The vehicle is used for both personal as well as official. A car allowance or mileage reimbursement can be taxable income for the employee depending on how the employer keeps track of it. Your car allowance is taxed at source at your personal income tax rate.

Car Allowance Motus Vehicle Reimbursement Blog From motus.com

Car Allowance Motus Vehicle Reimbursement Blog From motus.com

If this is the case, please provide more details about who is paying the car allowance to you, and how it is taxed. In addition, a higher rate taxpayer might be better off driving a company car. A car allowance is what an employer pays their employees for using their personal vehicle for business reasons. At $0.58 per mile this equals $17,400.00. Make a company car allowance work for you. Using a favr system also results in a car allowance that isn’t taxable.

Keeping company car allowances fair is important for your business and your employees.

According to irs publication 463, a car allowance meets the accounting requirements for the amount of an employee’s expenses only if. The car allowance is grouped together with your salary for tax purposes, so you’ll be taxed in line with your personal income tax bracket. Make a company car allowance work for you. Actual amount of expenditure incurred by the employer on the running and maintenance of motor car including remuneration paid by the employer to the chauffeur and increased by the amount representing normal wear and tear of the motor car at 10% p.a. The irs views the car allowance as taxable income and considers it as a form of bonus. Car allowance policy for employees the vehicle is used only for the official purpose.

Source: farnoushdesign.blogspot.com

Source: farnoushdesign.blogspot.com

There’s also tax to consider. Car allowances are taxable we can skip over the fact that car allowance programs do not fairly distribute money to its mobile workforce. How does car allowance affect your tax? A car allowance or mileage reimbursement can be taxable income for the employee depending on how the employer keeps track of it. Both employee and employer must also pay fica/medicare taxes on the allowance.

Source: locobatodesigns.blogspot.com

Source: locobatodesigns.blogspot.com

The amount of cash you end up with after taxes could be significantly lower than the value of a company car. The car allowance is grouped together with your salary for tax purposes, so you’ll be taxed in line with your personal income tax bracket. My car allowance is taxable. Car allowance policy for employees the vehicle is used only for the official purpose. However, it doesn’t mean that your car allowance is.

Source: carcrot.blogspot.com

Source: carcrot.blogspot.com

In addition, a higher rate taxpayer might be better off driving a company car. But we cannot ignore its. Actual amount of expenditure incurred by the employer on the running and maintenance of motor car including remuneration paid by the employer to the chauffeur and increased by the amount representing normal wear and tear of the motor car at 10% p.a. Car allowances are taxable we can skip over the fact that car allowance programs do not fairly distribute money to its mobile workforce. The car’s p11d value is what’s reported to the government.

Source: motus.com

Source: motus.com

Roles companies moving between inland revenue sites An allowance paid to an employee is taxable income, and tax is required to be withheld from the payments according to the prescribed tax scales, unless it excluded. Using a favr system also results in a car allowance that isn’t taxable. There’s also tax to consider. If your employer has an “accountable” plan, in which it requires you to submit specific information about your.

Source: carcrot.blogspot.com

Source: carcrot.blogspot.com

In addition, a higher rate taxpayer might be better off driving a company car. My car allowance is taxable. Your car allowance is taxed at source at your personal income tax rate. You will need to pay your employees the same wages you would if they received a car allowance. A standard car allowance is considered taxable income because it does not substantiate business use.

Source: easifleet.com.au

Source: easifleet.com.au

Adding an extra penny to your monthly car allowance for tax season will also raise your overall costs. But we cannot ignore its. In addition, a higher rate taxpayer might be better off driving a company car. Cash allowances for company cars are typically added onto the employee’s monthly salary, which means it�s subject to normal income tax. The amount of cash you end up with after taxes could be significantly lower than the value of a company car.

Source: carcrot.blogspot.com

Source: carcrot.blogspot.com

I drive 40,000 miles per year and 30,000 miles is strictly business related. The irs views the car allowance as taxable income and considers it as a form of bonus. Reimbursing allowances you can reimburse employees for expenses they pay while doing their job, for example meals, vehicles or tools. Instead of reimbursements for travel, car allowances are taxable as such by the irs. Cash allowances for company cars are typically added onto the employee’s monthly salary, which means it�s subject to normal income tax.

Source: silvertaxgroup.com

Source: silvertaxgroup.com

In addition, a higher rate taxpayer might be better off driving a company car. What makes a car allowance taxable? I drive 40,000 miles per year and 30,000 miles is strictly business related. If your employer has an “accountable” plan, in which it requires you to submit specific information about your. However, the company is responsible for paying the expenses for the car, and the allowance is reduced by the.

Source: carretro.blogspot.com

Source: carretro.blogspot.com

Reimbursing allowances you can reimburse employees for expenses they pay while doing their job, for example meals, vehicles or tools. The amount of cash you end up with after taxes could be significantly lower than the value of a company car. You should check the award that Will i get taxed on my company car allowance? However, you then have the issue of wear and tear of your car.

Source: carcrot.blogspot.com

Source: carcrot.blogspot.com

Car allowances are taxable we can skip over the fact that car allowance programs do not fairly distribute money to its mobile workforce. You must include any allowance you receive from your employer for car expenses, as assessable income in your tax return. However, the company is responsible for paying the expenses for the car, and the allowance is reduced by the. Company paid $3,300 for gas. The vehicle is used for both personal as well as official.

Source: mburse.com

As a result, higher rate taxpayers will pay a 40% tax on allowances if they are in this category. Car allowances are taxable we can skip over the fact that car allowance programs do not fairly distribute money to its mobile workforce. Are car allowances taxable income? View solution in original post. You would also need to keep a.

Source: motus.com

Source: motus.com

Adding an extra penny to your monthly car allowance for tax season will also raise your overall costs. Car allowance policy for employees the vehicle is used only for the official purpose. One of the main differences of giving your employees an allowance, instead of a company car, is that you take car allowance tax out of the employee’s main earnings at the normal income tax rate. Actual amount of expenditure incurred by the employer on the running and maintenance of motor car including remuneration paid by the employer to the chauffeur and increased by the amount representing normal wear and tear of the motor car at 10% p.a. However, it doesn’t mean that your car allowance is.

Source: easifleet.com.au

Source: easifleet.com.au

With an accountable plan, companies don�t have to report these as pay. This is because you pay the allowance as part of your employee’s salary. This payment is in addition to their salary or wages. You want to attract and keep employees and avoid labor concerns. If this is the case, please provide more details about who is paying the car allowance to you, and how it is taxed.

Source: microsoft.com

Source: microsoft.com

There’s also tax to consider. With an accountable plan, the employer. Is a car allowance taxable? Using a favr system also results in a car allowance that isn’t taxable. There’s also tax to consider.

Source: carretro.blogspot.com

Source: carretro.blogspot.com

Reimbursing allowances you can reimburse employees for expenses they pay while doing their job, for example meals, vehicles or tools. The amount of cash you end up with after taxes could be significantly lower than the value of a company car. Make a company car allowance work for you. The amount of a car allowance is based on the employee’s income and the tax rate. A fixed monthly car allowance is considered taxable income at federal and state levels.

Source: carcrot.blogspot.com

Source: carcrot.blogspot.com

Your car allowance is taxed at source at your personal income tax rate. Using someone else�s car or other vehicle A taxable vehicle allowance is not appropriate for the needs of employees. Is a car allowance taxable? There’s also tax to consider.

Source: caindelhi.in

Source: caindelhi.in

You should check the award that If your employer has an “accountable” plan, in which it requires you to submit specific information about your. How does a car allowance work for tax purposes? This payment is in addition to their salary or wages. With an accountable plan, the employer.

Source: carcrot.blogspot.com

Source: carcrot.blogspot.com

With an accountable plan, companies don�t have to report these as pay. An allowance paid to an employee is taxable income, and tax is required to be withheld from the payments according to the prescribed tax scales, unless it excluded. One of the main differences of giving your employees an allowance, instead of a company car, is that you take car allowance tax out of the employee’s main earnings at the normal income tax rate. The exceptions depend on exactly what the allowance is for and how it is calculated. However, it doesn’t mean that your car allowance is.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title car allowance taxable by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.