Your Can you purchase a car with a credit card images are available. Can you purchase a car with a credit card are a topic that is being searched for and liked by netizens today. You can Download the Can you purchase a car with a credit card files here. Find and Download all free images.

If you’re looking for can you purchase a car with a credit card pictures information connected with to the can you purchase a car with a credit card interest, you have visit the ideal blog. Our site always provides you with hints for downloading the maximum quality video and picture content, please kindly hunt and locate more enlightening video content and graphics that match your interests.

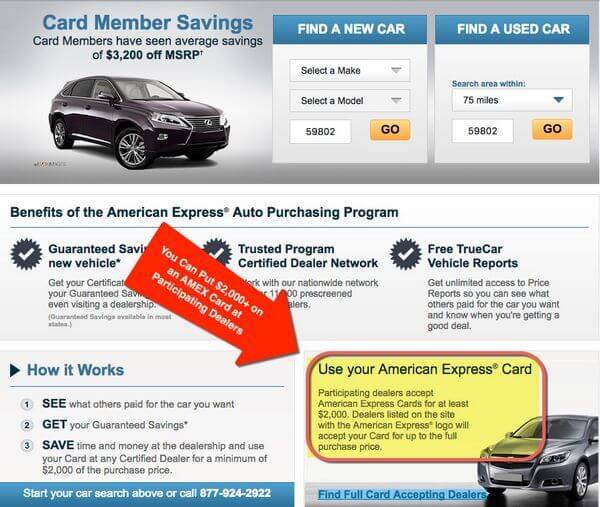

Can You Purchase A Car With A Credit Card. On a $30,000 car, that’s $900. If you were able to make that purchase with a credit card such as the citi double cash, which offers 2%. Other important benefits of the ink business unlimited card are employee cards for no additional fee, primary rental car insurance, zero liability fraud coverage, purchase protection, and extended warranty protection. For example, if you want to buy a $30,000 car with a credit card, and the dealership must pay a processing fee of 3%, it’d have to pay $900 on that one transaction.

Can You Buy a Car With a Credit Card? Credit Karma From creditkarma.com

Can You Buy a Car With a Credit Card? Credit Karma From creditkarma.com

So getting the best deal and earning rewards at the same. If you can make a purchase on credit card rather than a charge card, consider the interest rate on the card. Buying a car with a credit card can make sense if you can earn some rewards and save money on interest for a limited time. The idea of buying your new car with a credit card seems cut and dry. Interest rates on auto loans are almost always lower than on credit cards. Tips for buying a car with a credit card.

Buying with a credit card has downsides.

Tips for buying a car with a credit card. For the average man on the street, your interest rate on a credit card is in the region of 20.5% while vehicle finance interest can be around the 12% mark for those with a good credit score. In an ideal scenario, you would get the longest 0% credit card that you can, be it a purchase card or a money transfer card. The idea of buying your new car with a credit card seems cut and dry. You might even be able to use a card to buy a vehicle. On large purchases, processing fees can add up quickly.

Source: millionmilesecrets.com

Source: millionmilesecrets.com

Much like a regular credit card, you earn rewards with every purchase, and you can. You will only end up paying more in the long run. Using a credit card to fund the purchase of a new car is less common than taking out a personal loan, or using car finance options like personal contract purchase and hire purchase. Making a down payment or buying a car outright with a credit card may not seem like a great idea. The idea of buying your new car with a credit card seems cut and dry.

Source: thesimpledollar.com

Source: thesimpledollar.com

For you, using a credit card is a convenience or maybe a necessity. If you were to do this, your debt is cleared at the end of the 0% period, so you pay no interest, meaning the credit hasn’t. So getting the best deal and earning rewards at the same. That fee can run as high as 3% of the total cost; The idea of buying your new car with a credit card seems cut and dry.

Source: jdpower.com

Spend between £100 and £30,000 on. If you were to do this, your debt is cleared at the end of the 0% period, so you pay no interest, meaning the credit hasn’t. Another potential option that is worth mentioning is getting an automakers� branded credit card. Using a credit card to fund the purchase of a new car is less common than taking out a personal loan, or using car finance options like personal contract purchase and hire purchase. In an ideal scenario, you would get the longest 0% credit card that you can, be it a purchase card or a money transfer card.

Source: consumeraffairs.com

Source: consumeraffairs.com

Interest rates on auto loans are almost always lower than on credit cards. Buying with a credit card has downsides. If you can find a dealer that will let you charge your car, and if you can pay back the amount you charge when the bill is due, buying a car with a. That fee can run as high as 3% of the total cost; In general, car dealerships accept credit cards.

Source: aaaliving.acg.aaa.com

Source: aaaliving.acg.aaa.com

On large purchases, processing fees can add up quickly. You can you buy a car with a credit card, but it won’t be easy and, for many buyers, it’s not a great idea. If you can afford to pay the balance off immediately, buying a car with a credit card can be a great way to rack up rewards, but just because. The blue business® plus credit card from american express. Tips for buying a car with a credit card.

Source: badcredit.org

Source: badcredit.org

But it may be smart to ask yourself if this is the best way for you to purchase your vehicle. You’d then use it to buy the car, and pay off a set amount each month, clearing your balance before your 0% interest rate expires. If you plan on paying off your card after charging a car purchase to it, then you can mitigate potential negative impacts on your credit. If you can afford to pay the balance off immediately, buying a car with a credit card can be a great way to rack up rewards, but just because. If you were able to make that purchase with a credit card such as the citi double cash, which offers 2%.

Source: badcredit.org

Source: badcredit.org

But not every dealer will accept credit cards and those who do will charge you more to cover their card processing fees. Assuming a $30,000 vehicle price and a 2% processing fee, that’s $600 ($30,000 x 2%). Buying a car with a credit card can make sense if you can earn some rewards and save money on interest for a limited time. You’d then use it to buy the car, and pay off a set amount each month, clearing your balance before your 0% interest rate expires. If you were to do this, your debt is cleared at the end of the 0% period, so you pay no interest, meaning the credit hasn’t.

Source: creditcards.com

Source: creditcards.com

First, keep in mind the dealership will have to pay a credit card processing fee if they decide to accept a card. On a $30,000 car, that’s $900. In an ideal scenario, you would get the longest 0% credit card that you can, be it a purchase card or a money transfer card. Using a card with a zero percent introductory interest rate is nice as long as you get the balance paid off before the introductory period is. One of the most obvious reasons not to buy a car with a credit card is the size of the purchase.

Source: badcredit.org

Source: badcredit.org

You can’t purchase gap insurance on a credit card balance like you can on a traditional car loan. For example, if you want to buy a $30,000 car with a credit card, and the dealership must pay a processing fee of 3%, it’d have to pay $900 on that one transaction. Many dealers refuse credit card transactions or limit the dollar amount of such transactions due to the hefty transaction fees that often accompany them. But it may be smart to ask yourself if this is the best way for you to purchase your vehicle. But if you have the cash to pay off the card immediately, it can be a great way to rack up rewards on a major purchase.

Source: bankruptcy-canada.ca

Source: bankruptcy-canada.ca

Another potential option that is worth mentioning is getting an automakers� branded credit card. Assuming a $30,000 vehicle price and a 2% processing fee, that’s $600 ($30,000 x 2%). However, it’s more likely that the dealership will take a credit card for a down payment or a part of the down payment up to a certain amount. Much like a regular credit card, you earn rewards with every purchase, and you can. But not every dealer will accept credit cards and those who do will charge you more to cover their card processing fees.

![]() Source: mybanktracker.com

Source: mybanktracker.com

So getting the best deal and earning rewards at the same. For the average man on the street, your interest rate on a credit card is in the region of 20.5% while vehicle finance interest can be around the 12% mark for those with a good credit score. Pay off the balance in full. As with any purchase, you give the salesperson your card and then sign when and where you need to make the vehicle legally yours. That way, you can earn significant points, miles or cash back from your rewards credit card, at no cost to you.

According to kelly blue book, the average price for a light vehicle purchased in the united states was $38,378 as of july 2020. First, keep in mind the dealership will have to pay a credit card processing fee if they decide to accept a card. The first way to do this is simple: However, it’s more likely that the dealership will take a credit card for a down payment or a part of the down payment up to a certain amount. Purchasing a car with a credit card is a great way to earn a large sum of points, miles or cash back.

![Capital One Auto Loan [2020 Review] Capital One Auto Loan [2020 Review]](https://cdn.motor1.com/images/mgl/OVN3l/s1/capital-one-auto-loan.jpg) Source: motor1.com

Source: motor1.com

However, don’t forget to follow the 10 commandments for travel rewards credit cards. Much like a regular credit card, you earn rewards with every purchase, and you can. The idea of buying your new car with a credit card seems cut and dry. But not every dealer will accept credit cards and those who do will charge you more to cover their card processing fees. In general, car dealerships accept credit cards.

Source: carfax.com

Source: carfax.com

If you’ve charged the car to a credit card without a 0% purchase rate, act fast to avoid interest charges. Purchasing a car with a credit card is a great way to earn a large sum of points, miles or cash back. Spend between £100 and £30,000 on. So getting the best deal and earning rewards at the same. On large purchases, processing fees can add up quickly.

Source: cardrates.com

Source: cardrates.com

So getting the best deal and earning rewards at the same. If you can afford to pay the balance off immediately, buying a car with a credit card can be a great way to rack up rewards, but just because. Thus, it makes no sense to purchase the car on a credit card. Whether or not you can purchase a vehicle with a credit card will depend on the dealer and the policies they have in place for certain transactions. However, don’t forget to follow the 10 commandments for travel rewards credit cards.

Source: iroot4.com

Source: iroot4.com

Assuming a $30,000 vehicle price and a 2% processing fee, that’s $600 ($30,000 x 2%). Tips for buying a car with a credit card. Spend between £100 and £30,000 on. This fee could be ~1% to ~3% of the sales price, depending on what type of credit card you’re using. But not every dealer will accept credit cards and those who do will charge you more to cover their card processing fees.

Source: canstar.com.au

Source: canstar.com.au

But it may be smart to ask yourself if this is the best way for you to purchase your vehicle. Many dealers refuse credit card transactions or limit the dollar amount of such transactions due to the hefty transaction fees that often accompany them. You might even be able to use a card to buy a vehicle. On large purchases, processing fees can add up quickly. For the average man on the street, your interest rate on a credit card is in the region of 20.5% while vehicle finance interest can be around the 12% mark for those with a good credit score.

Source: gearnova.com

Source: gearnova.com

The idea of buying your new car with a credit card seems cut and dry. One of the most obvious reasons not to buy a car with a credit card is the size of the purchase. Using a card with a zero percent introductory interest rate is nice as long as you get the balance paid off before the introductory period is. As with any purchase, you give the salesperson your card and then sign when and where you need to make the vehicle legally yours. Whether or not you can purchase a vehicle with a credit card will depend on the dealer and the policies they have in place for certain transactions.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title can you purchase a car with a credit card by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.