Your Biweekly car payment calculator images are available in this site. Biweekly car payment calculator are a topic that is being searched for and liked by netizens now. You can Get the Biweekly car payment calculator files here. Find and Download all free vectors.

If you’re looking for biweekly car payment calculator pictures information related to the biweekly car payment calculator topic, you have visit the ideal blog. Our website frequently gives you hints for downloading the maximum quality video and image content, please kindly search and locate more enlightening video articles and graphics that fit your interests.

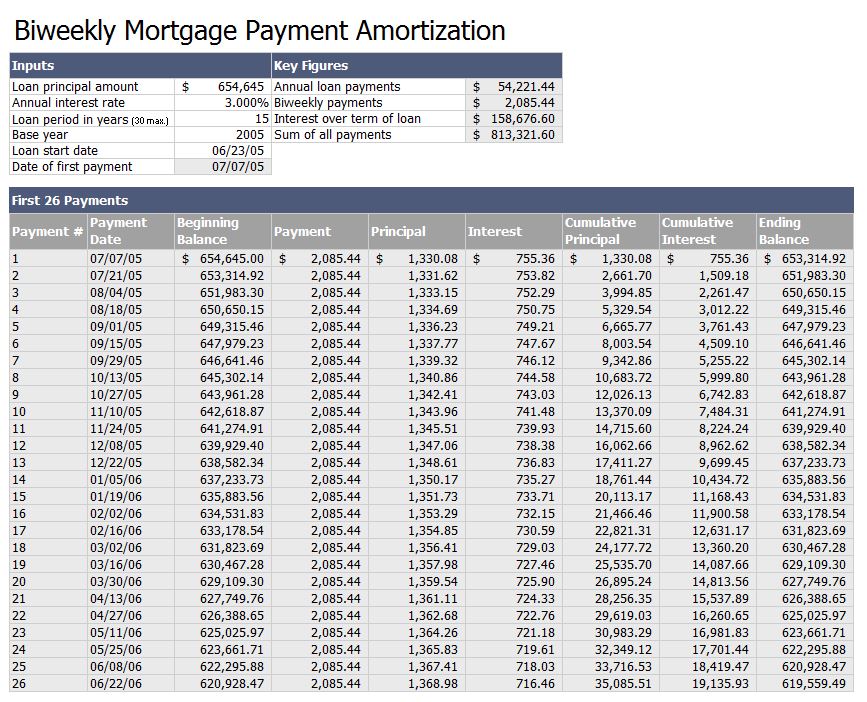

Biweekly Car Payment Calculator. This calculator shows you possible savings by using an accelerated biweekly mortgage payment. Each year has 52 weeks or 26 biweekly periods in it, which makes shifting from monthly payments to biweekly payments create an effective 13th monthly payment to pay down the loan quicker. When you click on calc, the amount of the loan and the monthly payment will be calculated. If you pay half of each monthly loan payment every other week it is like making a 13th monthly loan payment.

Car Loan Calculator Esanda to work out regular monthly From canis-avocats.com

Car Loan Calculator Esanda to work out regular monthly From canis-avocats.com

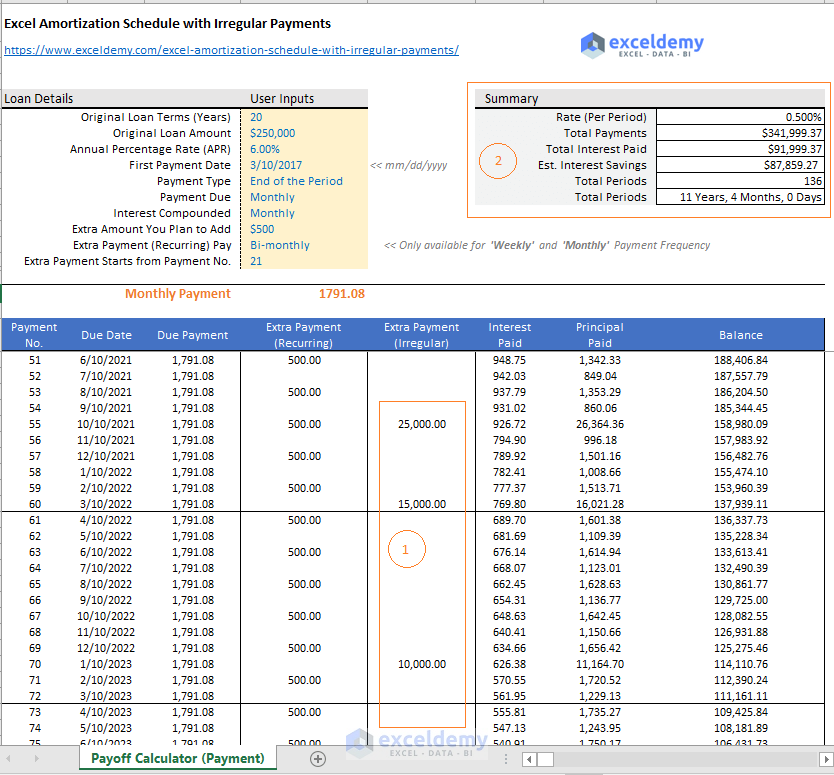

Biweekly payments accelerate your mortgage payoff by paying 1/2 of your normal monthly payment every two weeks. Pros and cons of biweekly payments. The calculator also includes the option of adding an extra amount to your biweekly payment, either on a biweekly (fortnightly) or on a monthly basis. If you enter the loan amount and 0 for the down payment amount, then the calculator. By the end of each year, you will have paid the equivalent of 13 monthly payments instead of 12. First enter the principal balance owed, as well as an annual interest rate and the loan term in months.

To indicate an unknown value, enter 0 (zero).

Click on calculate and you’ll get a payment amount for both monthly and biweekly schedules. Since there are 52 weeks in a year that equates to 26 biweekly payment periods. Whether you are buying an used car or finance for a new car, you will find this auto loan calculator come in handy. Biweekly payments for an auto loan calculator this calculator shows you possible savings by using an accelerated biweekly payment on your auto loan. Making a payment every other week, rather than once a month, can let you pay off your loan faster and save money on interest in the process. Biweekly car loan payment calculator hot www.calculators.org.

Source: tesatew.blogspot.com

Source: tesatew.blogspot.com

Go auto’s car loan calculator. Since there are 52 weeks in a year that equates to 26 biweekly payment periods. If you pay half of each monthly loan payment every other week it is like making a 13th monthly loan payment. As there are 52 weeks in a year, that means there are 26 biweekly. By paying half of your monthly payment every two weeks, each year your auto loan company will receive the equivalent of 13 monthly payments instead of 12.

Source: sampletemplates.com

Source: sampletemplates.com

Usage this biweekly automobile payment calculator to see for yourself exactly how making biweekly settlements on your auto loan will conserve you hundreds to lots of hundreds of dollars during your loan. Bi weekly pay calculator will certainly assist you to review the costs in between a loan that is settled on a biweekly basis and a loan that is repaid on a monthly basis. Enter the principal balance owed : Car loan calculator with amortization schedule and extra payments to calculate the monthly payment for your car loan. Even a modestly priced vehicle—let’s say $8,000 to $10,000—is more than most people can afford to pay with cash.

Source: loanwalls.blogspot.com

Source: loanwalls.blogspot.com

This calculator can be used to demonstrate the advantages of a biweekly (every two weeks) car loan. Biweekly payments for an auto loan calculator. Biweekly payments accelerate your mortgage payoff by paying 1/2 of your normal monthly payment every two weeks. The resulting payments are much easier to blend into your budget, as long as you can remember them. The calculator also includes the option of adding an extra amount to your biweekly payment, either on a biweekly (fortnightly) or on a monthly basis.

Source: ufreeonline.net

Source: ufreeonline.net

Go auto’s car loan calculator. The calculator needs a total of three inputs, including: The amount of biweekly payments is exactly half of your current monthly payment or what your monthly payment would be if you still do not have the loan. As there are 52 weeks in a year, that means there are 26 biweekly. Enter the your car loan�s current interest rate:

Source: culturopedia.net

Source: culturopedia.net

Our biweekly payment calculator can do more than save you money on your total debt payment. The resulting payments are much easier to blend into your budget, as long as you can remember them. You can enter the car price, the down payment amount available, the total number of periods, and the interest rate. Understanding how to calculate payments and how it works is simple. Go auto’s car loan calculator.

Source: tesatew.blogspot.com

By the end of each year, you will have paid the equivalent of 13 monthly payments instead of 12. Our biweekly payment calculator can do more than save you money on your total debt payment. That said, you�re not completely out of luck if you don�t have a sizable down payment on hand when your current vehicle craps out and you find yourself immediately in need of new. This is the monthly payment necessary to repay the car loan over its lifetime. You divide your monthly payments into two.

Source: westernmotodrags.com

Source: westernmotodrags.com

Biweekly vs monthly loan calculator. Use a biweekly calculator online (see resources) or do it yourself. Biweekly payments for an auto loan calculator this calculator shows you possible savings by using an accelerated biweekly payment on your auto loan. The calculator needs a total of three inputs, including: By paying half of your monthly payment every two weeks, each year your auto loan company will receive the equivalent of 13 monthly payments instead of 12.

Source: loanwalls.blogspot.com

Source: loanwalls.blogspot.com

As there are 52 weeks in a year, that means there are 26 biweekly. If you enter the loan amount and 0 for the down payment amount, then the calculator. As there are 52 weeks in a year, that means there are 26 biweekly. Biweekly payments for an auto loan calculator. Go auto’s car loan calculator.

Source: tesatew.blogspot.com

Source: tesatew.blogspot.com

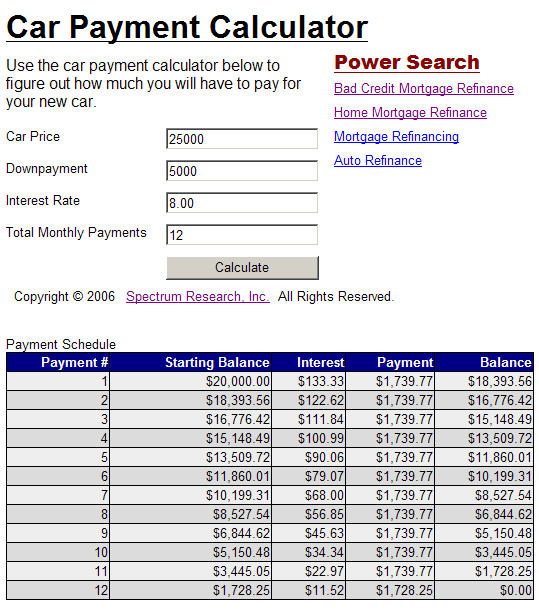

This calculator provides the user with two monthly loan payments: The car loan value, which is how much money is being lent to the borrower. The term of the loan, stating in years. Each year has 52 weeks or 26 biweekly periods in it, which makes shifting from monthly payments to biweekly payments create an effective 13th monthly payment to pay down the loan quicker. A biweekly payment schedule splits the difference between lowering monthly payments or the principal.

Source: carpaymentcalculator.net

Source: carpaymentcalculator.net

The resulting payments are much easier to blend into your budget, as long as you can remember them. Enter the principal balance owed : Click on calculate and you’ll get a payment amount for both monthly and biweekly schedules. Bi weekly pay calculator will certainly assist you to review the costs in between a loan that is settled on a biweekly basis and a loan that is repaid on a monthly basis. By paying half of your monthly payment every two weeks, each year your auto loan company will receive the equivalent of 13 monthly payments instead of 12.

Source: chateauxdelameuse.eu

Source: chateauxdelameuse.eu

Purchasing a vehicle usually requires a significant financial investment. Biweekly payment calculator see how biweekly payments can make it easier to eliminate your debt quickly. Biweekly payments for an auto loan calculator this calculator shows you possible savings by using an accelerated biweekly payment on your auto loan. That said, you�re not completely out of luck if you don�t have a sizable down payment on hand when your current vehicle craps out and you find yourself immediately in need of new. By paying half of your monthly payment every two weeks, each year your auto loan company will receive the equivalent of 13 monthly payments instead of 12.

Source: loanwalls.blogspot.com

Source: loanwalls.blogspot.com

Current redmond auto loan rates are published in a table below the calculator. Go auto’s car loan calculator. This calculator shows you possible savings by using an accelerated biweekly payment on your auto loan. After you have entered your current information, use the graph options to see how different loan terms or down. Current redmond auto loan rates are published in a table below the calculator.

Source: finance-review.com

Source: finance-review.com

If you want to calculate regular biweekly payments instead of accelerated payments please use our biweekly loan calculator. Usage this biweekly automobile payment calculator to see for yourself exactly how making biweekly settlements on your auto loan will conserve you hundreds to lots of hundreds of dollars during your loan. Biweekly payment calculator see how biweekly payments can make it easier to eliminate your debt quickly. By paying half of your monthly payment every two weeks, each year your auto loan company will receive the equivalent of 13 monthly payments instead of 12. Each year has 52 weeks or 26 biweekly periods in it, which makes shifting from monthly payments to biweekly payments create an effective 13th monthly payment to pay down the loan quicker.

Source: canis-avocats.com

Source: canis-avocats.com

This calculator provides the user with two monthly loan payments: You can enter the car price, the down payment amount available, the total number of periods, and the interest rate. This calculator shows you possible savings by using an accelerated biweekly payment on your auto loan. Even a modestly priced vehicle—let’s say $8,000 to $10,000—is more than most people can afford to pay with cash. Pros and cons of biweekly payments.

The term of the loan, stating in years. If you want to calculate regular biweekly payments instead of accelerated payments please use our biweekly loan calculator. You divide your monthly payments into two. When you click on calc, the amount of the loan and the monthly payment will be calculated. Even a modestly priced vehicle—let’s say $8,000 to $10,000—is more than most people can afford to pay with cash.

Source: s3.amazonaws.com

Source: s3.amazonaws.com

To indicate an unknown value, enter 0 (zero). Whether you are buying an used car or finance for a new car, you will find this auto loan calculator come in handy. As there are 52 weeks in a year, that means there are 26 biweekly. The calculator also includes the option of adding an extra amount to your biweekly payment, either on a biweekly (fortnightly) or on a monthly basis. This simple technique can shave time off.

Source: goamplify.com

Source: goamplify.com

If you enter the loan amount and 0 for the down payment amount, then the calculator. Biweekly car loan payment calculator hot www.calculators.org. Enter the your car loan�s current interest rate: If you enter the loan amount and 0 for the down payment amount, then the calculator. Purchasing a vehicle usually requires a significant financial investment.

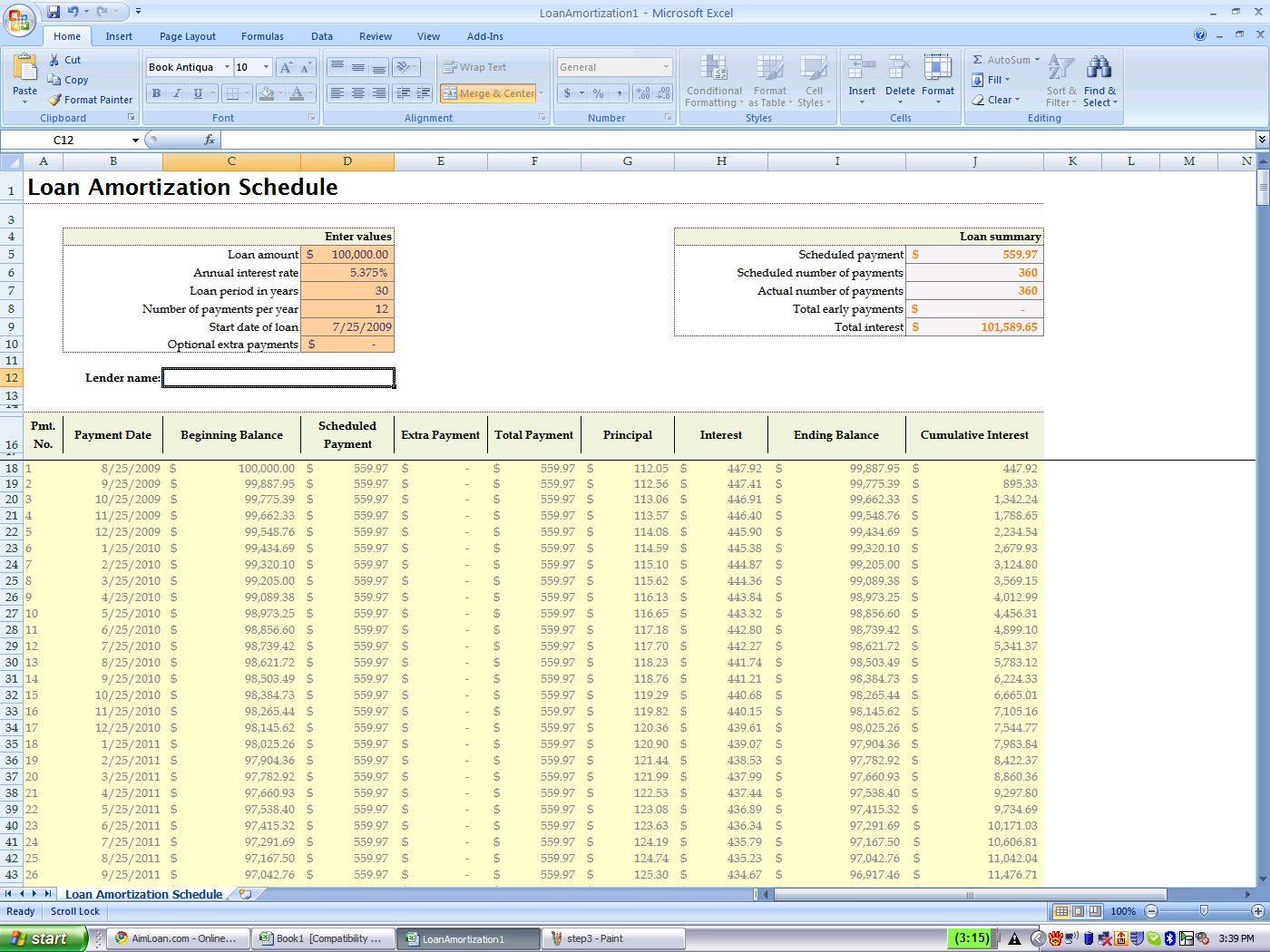

Source: exceltemplates.net

Source: exceltemplates.net

If you want to calculate regular biweekly payments instead of accelerated payments please use our biweekly loan calculator. This calculator shows you possible savings by using an accelerated biweekly payment on your auto loan. We also offer a separate biweekly mortgage calculator. Bi weekly pay calculator will certainly assist you to review the costs in between a loan that is settled on a biweekly basis and a loan that is repaid on a monthly basis. In conclusion, according to one us online calculator (navy federal credit union), the biweekly payment for a $25,000 loan at 7% for 60 months is $247.52, which can be calculated by:

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title biweekly car payment calculator by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.